Why Practice Management Software Is a Key Growth Strategy for Accounting Firms

Growth is good — until the work outpaces the workflow. Many accounting firms add clients faster than they add structure, and the result is familiar: deadline crunches, scattered communication, and too much time spent coordinating instead of serving. Accounting practice management software changes that equation. It centralizes work, clarifies accountability, and gives firm leaders real-time visibility so teams can scale without burning out.

This isn’t tech for tech’s sake.

In the AICPA & CIMA PCPS 2024 Top Issues Survey, firms of all sizes cited staffing challenges as their number one concern. At the same time, both sole proprietors and large firms identified technology adoption — and the need to use it to improve client service — as top strategic priorities. These issues are not separate. When skilled staff are in short supply, the capacity and consistency of the team you do have become critical. The right technology can offset headcount pressure by automating routine work, streamlining handoffs, and giving each professional more bandwidth for high-value tasks. In other words, solving the talent challenge increasingly depends on how well a firm leverages its technology.

Explore how the right software can support your firm’s growth—download the Firm360 Buyer’s Guide to compare your options.

How Practice Management Software Streamlines Workflow for Growth

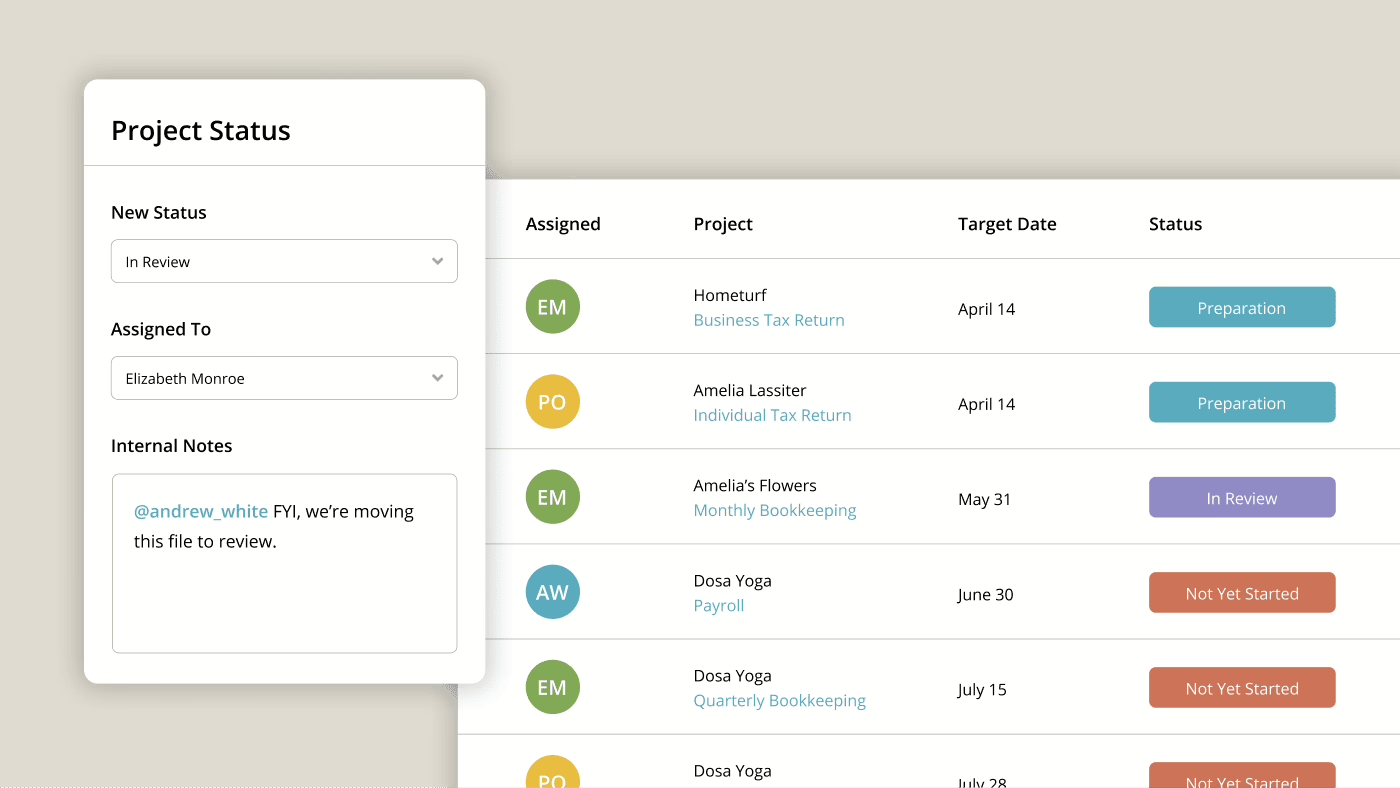

Practice management systems bring engagements, tasks, documents, and deadlines into one platform tied to how accounting work actually happens. That means standardized workflows, clear owners, and status visibility across returns, attest engagements, and advisory work. Our profession has emphasized for years that disciplined workflow design improves productivity and client satisfaction; firms that codify processes see fewer surprises and smoother handoffs.

Client communication belongs in that same single source of truth. Moving sensitive exchanges out of email and into secure portals reduces risk and saves time. Journal of Accountancy guidance explicitly recommends portals over customary email, especially to mitigate fraud and protect client data.

Security & Compliance as Pillars of Your Accounting Firm Growth Strategy

A modern practice runs on client data that hackers are eager to capture and exploit. Accounting firms are increasingly at risk of attack and need to be prepared to respond.

Disciplined processes, multifactor authentication, user training, and response plans are all nonnegotiable starting points for data security. Technology can streamline much of the work to secure your processes, and this is where practice management systems have a critical role to play.

Rather than relying on humans alone to drive security, the best-of-breed accounting practice management systems build security into their ecosystems. Hosting, data encryption, authentication and access controls, payment processing, and data exports are just some of the elements where security is built into the system itself.

Explore the key security features in our accounting practice management cybersecurity guide.

Using Automation to Accelerate Your Accounting Firm’s Growth

When coordination lives in email and spreadsheets, administrators and senior partners lose hours each week to status chasing. Practice management software automates reminders, standardizes intake, and centralizes progress, freeing capacity for review, coaching, and client conversations. Better workload distribution, realistic scheduling, and smarter time practices are strongly linked with lower burnout and better retention — essential during a prolonged talent shortage.

How Real-Time Dashboards Improve Decision-Making in Accounting Firms

Scaling requires more than effort; it requires insight. Centralized dashboards surface capacity, job status, cycle times, and realization so partners can reassign work before bottlenecks hit, spot scope creep, and protect margins. International Federation of Accountants (IFAC) guidance for small and medium practices stresses that digitalization is now foundational to firm resilience and growth, and that leaders should start with clear goals, phased steps, and change management.

Strategic Adoption of Practice Management Software for Accounting Firm Growth

For managing partners and growth-minded leaders: Set measurable targets tied to capacity and client experience. Examples: on-time delivery rate, rework percentage, days-to-close for monthly CAS, and return cycle times. Align workflows to those goals and publish a simple scorecard everyone can see. The AICPA’s practice transformation resources emphasize strategy first, tooling second.

For experienced senior partners who favor stability: Pilot first, then phase. Start with one practice area (for example, individual tax or compilations), migrate checklists and templates, and run a dual-track period where legacy and new systems overlap for safety. Focus your evaluation on simplicity, data migration clarity, support, and conservative ROI — areas seasoned firm leaders consistently prioritize.

For firm administrators and operations leads: Make the calendar sacred. Implement standardized intake, deadline dashboards, and automated workflows for common engagements. Keep instructions where the work happens, eliminate parallel trackers and reduce friction for your staff.

Supporting Growth Through Talent Retention and Modern Firm Culture

While pipeline challenges won’t be solved by software alone, your tech stack signals to current and future talent how the firm operates. Modern tools and flexible, disciplined processes play an important role in attracting and keeping the next generation. Practice management software supports that culture by making expectations clear, reducing administrative drag, and giving staff a fair shot at focused work.

The bottom line

Growing firms don’t need more heroic effort; they need a disciplined system that turns complexity into clarity. Practice management software provides that system. It aligns people and processes, elevates client experience, and anchors the security practices regulators expect. In an environment defined by talent constraints and rising expectations, that combination is a durable competitive edge.

Not all solutions are created equal. Use our Buyer’s Guide to evaluate accounting practice management software solutions based on what matters most to your growth goals.