AI in Accounting: What Mid-Sized Firms Must Know Now

Artificial intelligence is no longer a distant trend — it’s rapidly reshaping the accounting profession. While some firms are just beginning to experiment, others are embedding AI into daily operations, from workflow automation to advisory service delivery.

The firms that act now will define the future of accounting. This article draws on recent surveys, industry research, and publicly shared insights from accounting technology thought leaders. Their perspectives, combined with data from sources like Accounting Today and Wolters Kluwer, provide context on both the opportunities and the challenges facing firms.

The question for firm leaders isn’t whether AI in accounting will matter, but how quickly their firm can adopt it responsibly, securely, and strategically.

The State of AI Adoption in Accounting

The pace of AI adoption in accounting has gone from a crawl to a sprint. In 2023, only 1% of firms reported using AI tools for search and productivity. Just one year later, that number exploded to 35% — a leap that shows AI is no longer experimental, it’s becoming mainstream.

Generative AI — tools like ChatGPT that create text, summaries, or even analysis from prompts — is also moving quickly from buzzword to business tool. The Accountant Online reports that 27% of tax and accounting professionals already use it in their work, and another 22% plan to adopt it within the year.

The leaders so far? Mid-sized firms (21–50 employees) and large firms (200+). They’re investing in AI to streamline operations and enhance client services, while many smaller firms are still watching cautiously from the sidelines.

But with adoption accelerating this fast, “wait and see” may no longer be a wise option.

Accountants’ Perspectives on AI Adoption and Use

Overall, accounting professionals are becoming more optimistic. A Wolters Kluwer survey found that 53% of accounting professionals view AI adoption positively.

Yet optimism is tempered by practical concerns:

- 44% cite data security and privacy as their biggest worry.

- 43% are concerned about accuracy.

- 35% point to the cost of implementation as a barrier.

This tension explains why adoption has been uneven: firms see the opportunity but hesitate without clear policies, training, and governance.

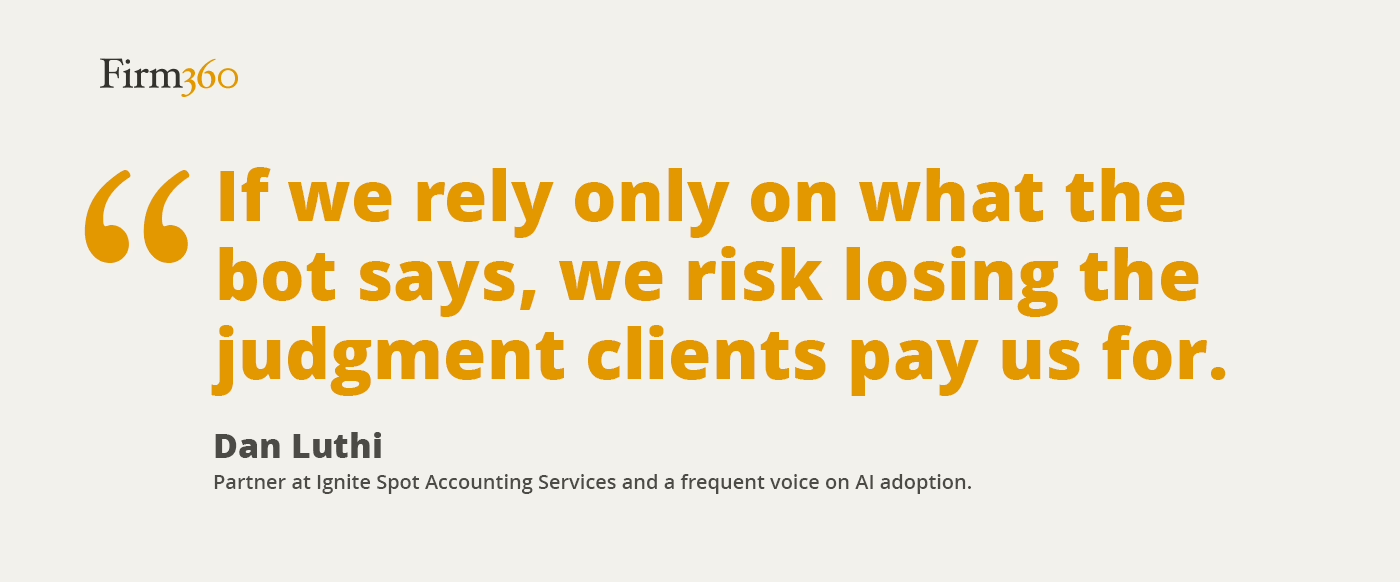

Dan Luthi, partner at Ignite Spot Accounting Services and a frequent voice on AI adoption, stresses that while AI brings efficiency, firms must not outsource their judgment. “If we rely only on what the bot says, we risk losing the judgment clients pay us for,” he explained on a recent industry podcast. His perspective highlights why training and critical thinking are just as essential as technology adoption.

How AI in Accounting Goes Beyond Automation

For years, technology in accounting meant digitizing manual processes: moving from desktop to cloud, automating reminders, or reducing paper. AI goes further. It not only automates but interprets and analyzes firm data.

Forward-thinking firms are using AI to:

- Identify their most profitable clients and money-losing accounts.

- Analyze staff utilization and workflows to eliminate bottlenecks.

- Generate first drafts of service descriptions, proposals, or research briefs.

- Support advisory conversations with scenario modeling and pricing intelligence.

The promise is not just efficiency — it’s intelligence that informs firm strategy.

This is where data organization becomes critical. AI is only as effective as the information it draws from, and messy or siloed data limits its value. As Chad Davis, co-founder of LiveCA and co-host of the AutomationTown podcast, has observed, too many vendors simply slap an “AI” label on old features. The real ROI comes when firms apply AI to well-defined, measurable problems — like shortening client onboarding or improving proposal workflows.

By keeping practice management information clean, centralized, and accessible, Firm360 gives firms the foundation to use AI effectively when they’re ready. Instead of chasing hype, leaders can build confidence knowing their data supports smarter, more strategic AI adoption.

AI in Accounting Creates Advisory Service Opportunities

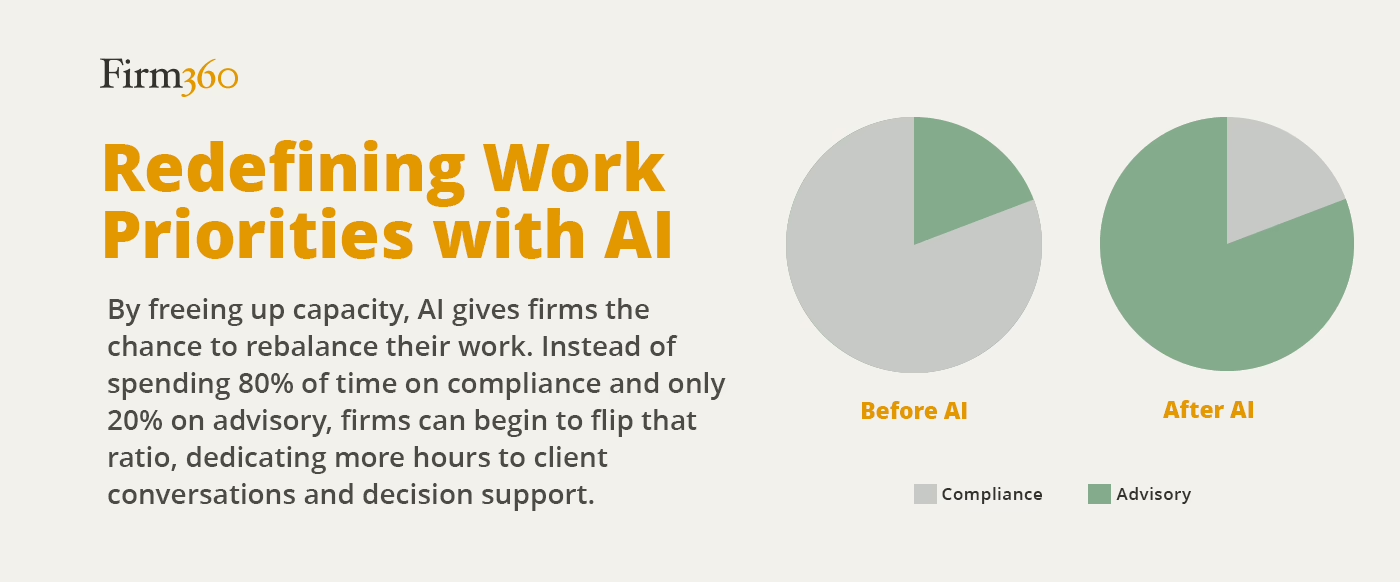

As AI takes over repetitive and transactional work — like reconciliations, categorizing expenses, or drafting first-pass reports — the human side of accounting becomes even more valuable. Advisory services, business coaching, and strategic guidance are areas where technology can’t replace professional judgment.

By freeing up capacity, AI gives firms the chance to rebalance their work. Instead of spending 80% of time on compliance and only 20% on advisory, firms can begin to flip that ratio, dedicating more hours to client conversations and decision support.

This shift isn’t just an internal priority — it’s a market opportunity. Many small businesses are already paying thousands of dollars to “financial coaches,” even when those coaches lack formal accounting expertise. Accountants are far better positioned to deliver that guidance, and AI provides the time and tools to step confidently into the role of trusted advisor.

Challenges of AI Adoption for Accounting Firms

Even with strong upside, challenges remain. Research highlights several barriers:

- Skills and Training: While 85% of firm leaders believe in AI’s potential, only 37% are investing in AI training. This leaves firms vulnerable to inefficiencies and missed opportunities.

- Shadow AI Risks: One of the fastest-growing issues is what experts call shadow AI — when staff use tools like ChatGPT, Gemini, or other AI apps without firm approval or oversight. It often starts innocently, like an employee asking an AI to rewrite an email or summarize a document. But if sensitive client data is pasted into an unsecured tool, that information could be exposed or even used to train the model. A 2025 survey found that 72% of professionals report using AI at work — up from 48% the year before — and nearly half admit they’ve used tools not authorized by their firm. This puts firms at risk of data breaches, compliance violations, and inaccurate outputs without leadership even knowing it’s happening.

- Data Governance: Without clear rules, staff may paste sensitive financial information into unsecured tools, risking breaches and compliance issues.

Byron Patrick, a nationally recognized CPA technology leader and AICPA instructor, emphasizes that firms must proactively address shadow AI by standardizing on secure team tools, disabling model training, and setting clear policies for staff use. His advice reflects the concerns of 44% of professionals who name security as their top barrier to adoption.

Best Practices for Accounting Firms Using AI

Firms that want to succeed with AI need to combine experimentation with guardrails. Based on current research and firm experiences, here are practical steps:

- Start Small, Scale Intentionally

Identify one high-friction workflow — such as drafting meeting notes, creating client emails, or summarizing tax law changes — and run a pilot. - Set Governance Policies Early

Clearly state what client data may and may not be shared with AI tools. Reinforce this in training and in your engagement letters. - Invest in Staff Training

Don’t assume new hires arrive “AI-ready.” Firms investing in training programs position themselves as more innovative and more attractive to recruits. - Standardize Secure Tools

Adopt team plans of AI platforms with SOC 2 certification and disabled model training to protect client confidentiality. - Encourage Sharing of Use Cases

Build a culture of experimentation by creating Slack channels, weekly huddles, or lunch-and-learns where team members can share how they’re applying AI.

Choosing the right platform matters too. Firm360 helps firms centralize workflows and keep practice data secure — a critical foundation for experimenting with AI responsibly.

As Byron Patrick has said, creating an environment where staff feel comfortable sharing new use cases is one of the most effective ways to build an AI culture. Small firms can adopt this approach without major cost, turning experimentation into firm-wide progress.

The Future of AI in Accounting

Looking ahead, AI will not replace accountants — it will augment their expertise. The firms that thrive will be those that:

- Reinvest time savings into stronger client relationships.

- Use AI insights to offer higher-value advisory services.

- Attract next-generation talent by positioning themselves as tech-forward.

- Differentiate on trust by implementing transparent, secure AI practices.

Workflows may shift, but human accountability, judgment, and empathy will remain at the heart of the profession. AI can write a recommendation, but only an accountant can build the relationship that makes a client act on it.

As Chad Davis observed in a recent CPA Practice Advisor article, “AI is already changing the game for accounting, enabling accountants to shift to higher-value advisory work and making firms more competitive.” Even as systems evolve, trust, transparency, and human connection will remain the profession’s most valuable differentiators. write a recommendation, but only an accountant can build the relationship that makes a client act on it.

Why Accounting Firms Must Act on AI Now

AI in accounting is no longer optional. Adoption is accelerating, client expectations are rising, and competitors are already moving. For mid-sized firms, the question is:

- Will you cautiously watch from the sidelines?

- Or will you embrace AI responsibly, turning automation into intelligence and intelligence into client value?

The benefits of implementing AI are clear: firms can streamline workflows, improve profitability analysis, strengthen compliance, and shift capacity toward high-value advisory services. Early adopters are already seeing gains in efficiency, client satisfaction, and revenue growth.

Firms that act now will be best positioned to grow — and they don’t have to figure it out alone. Firm360 helps mid-sized firms keep their practice data organized, clean, and accessible, giving them the foundation to adopt AI tools effectively. By centralizing workflows and client information in one secure system, Firm360 makes it easier for firms to explore AI responsibly while staying lean, compliant, and client-focused.

The firms that seize this moment won’t just keep up — they’ll set the standard for what the next decade of accounting looks like.